Timesaving SuperStream tips for your AccountRight clients

4th May, 2015

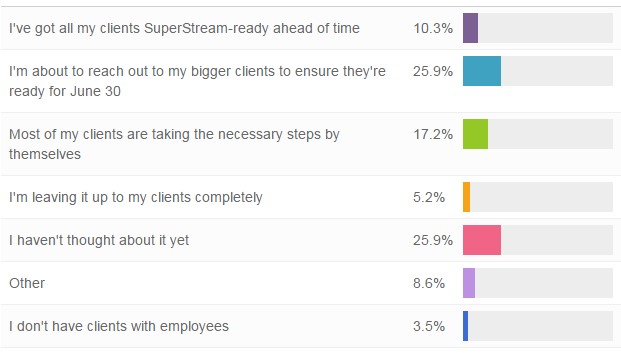

A recent poll I ran with accountants regarding SuperStream preparedness suggested there’s a fair amount of client education yet to be done. A quarter of respondents had yet to reach out to their larger clients, while a similar number hadn’t begun thinking about it yet.

Here’s the poll results for the interests of science:

Q: How prepared are you for SuperStream?

Perhaps a good start to getting everyone SuperStream-ready is to approach your existing AccountRight clients with the following super tips. Why the AccountRight clients? Because the new AccountRight features the Pay Super function, which makes SuperStream ridiculously easy to manage. So it’s an easy step for AccountRight clients to get cracking by simply starting to use Pay Super.

The first three tips below are general in nature. I would expect lots of oohs and ahhs from enlightened clients (hopefully). It’s tip four that will really delight AccountRight users. That’s because Pay Super manages tips one through three automatically! By the way, these tips come from the field, not me – I’m only passing on the knowledge.

1) Pay super contributions by EFT or BPAY, not cheque or in cash

Some super funds do not accept super contributions in cash or cheque at all. Others don’t accept cash or cheque contributions below a certain amount. Still others only accept cash contribution by specific methods like money order. Using EFT can help clients save time and hassle when making super contributions so they don’t spend all their time in the line at the local post office.

As you know, utilizing EFT to pay contributions is also a great way to keep a digital record of making a payment. The ATO is strict on record keeping and fines can be levied for incorrect record keeping.

2) Pay super contributions on time

The ATO is becoming increasingly strict enforcing superannuation deadlines. Being late, even by a day can attract a penalty. However, the time-consuming task is having to complete a Superannuation Guarantee Charge Statement. If your client has made a late contribution, the ATO often requests this report. That’s a time consuming task your clients don’t want. Plus, don’t forget late contributions are non-tax-deductable expenses and can cost thousands of dollars so it is in their best interests to pay on time.

3) Use AccountRight correctly, record employee superannuation details

Your clients really should use the Employee’s Card in AccountRight to record super fund information. Correctly storing an employee’s super fund details (like their membership number) on their employee card will provide quick access to details when they need to make contributions. What’s more, AccountRight provides the option to create a Superannuation Choice Form. It’s a great way for your client to provide the ATO with evidence that they’ve provided an employee a choice of super fund – a key super compliance requirement. Read details on how to enter superannuation information on an Employee Card in AccountRight.

BONUS TIME SAVING TIP: Why is proper record keeping worthwhile? Some super funds have different yet similar looking fund names. Your client does not want to make a contribution to the incorrect fund. Not only is it time consuming to correct this mistake (they’ll have to make a submission to the super fund and show proof of payment) but it could also get them in hot water with the ATO.

4) Use AccountRight to automate the contribution process

The latest version of AccountRight includes a feature called Pay Super. Your clients can use AccountRight to calculate the super contribution for your employee, verify the amount and authorise the amount in their software. The Pay Super feature will then process the payment for them. Just like that, MYOB will take care of the payment and transmission of the information through to the super fund.

…

There’s plenty to like about SuperStream. My colleague Sally Higgs wrote a nice piece for business owners called 4 reasons you’re going to love SuperStream.

And if you’re looking for resources to share with clients – whether AccountRight users or not – there are further resources I’ve shared on the MYOB Community Forum in the aptly named I’m an Accountant board. Do check it out. You don’t need to be a member of the forum to view the posts (although it’d be fantastic if you joined so you can contribute your voice).

Onward to July 1 and compliance for 20+ employee businesses.